December 2022 Market Update

December 2022 closed out the worst yearly performance for global equities in over a decade, with nearly every major asset class posting negative returns. Bonds, which have historically provided downside protection against equity market risk, fell alongside equities as a result of aggressive rate hikes in response to soaring inflation. There was no Santa Claus rally to end the year, with the S&P 500 falling 5.9% in December, closing the year with a total return of -19.44%.

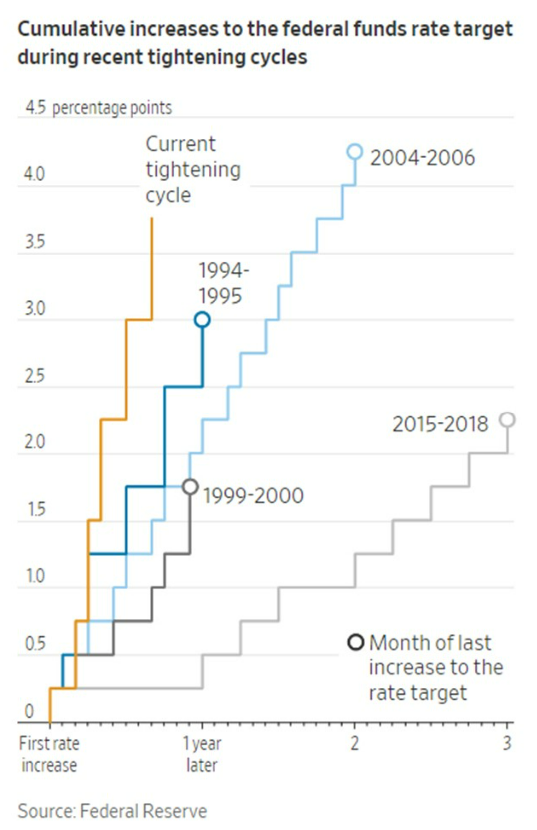

Figure 1: Magnitude of Recent Federal Reserve Rate Hike Cycles

It is likely that the United States will enter a recession in 2023, as the Federal Reserve continues to tighten its monetary policy. The Federal Reserve raised interest rates by 50 basis points (bps) in December, delivering an aggregate 425 bps increase in 2022 that took the policy rate from 0.25% in March, to 4.5% in December. This is the fastest monetary tightening cycle since the 1990’s, after U.S. inflation hit a 40-year high.

There are some positive signals that U.S. inflation should moderate in 2023. Softening housing demand, waning consumer confidence, and easing supply chain pressures may work to slow the increase in the consumer price index. Recent data shows a marginal decrease in annualized inflation, with the U.S. reporting a headline inflation rate of 7.7% for November 2022, its fifth consecutive monthly decrease from 9.1% in June. Market expectations have priced in an interest rate of 5% by March 2023, likely bringing an end to further tightening if inflation continues to recede.

Eurozone inflation remains elevated after reporting annualized headline inflation of 10% for November, just shy of the 10.6% reported in October. High commodity prices were a significant contributor to inflation, as a result of the Russia-Ukraine military conflict. Heading into winter, the Eurozone appears to have successfully stock-piled its gas reserves, and has so far been lucky with mild winter conditions putting little pressure on reserves. In the oncoming months, further infrastructure and diversification of Europe’s energy supply will be necessary to reduce inflationary pressures.

China has announced measures to accelerate its reopening process, following mass protests to its restrictive Covid-zero policy in November. A gradual softening of restrictions could likely present further challenges should the country see a surge in infections, but ultimately lead to a more sustainable recovery for the Chinese economy, and help to bolster global demand.

Heading into 2023, the U.S. and other global economies will look for signs of receding inflation to guide further monetary policy decisions. As monetary policy acts with a lag, past rate hikes are likely to weigh on the economy, raising the risk of an ensuing recession if central banks are too aggressive. While the market has already priced in much of the potential downside, it remains to be seen whether we have observed the market bottom. Should inflation come down sooner than expected, a softer landing could result in a strong year for both global bonds and equities.