October 2022 Market Update

Following a pullback in August and September, markets rallied in October as investors grew hopeful that tightening of fiscal policies worldwide may begin to slow. Equity prices have already priced in a significant amount of bad news this year, leaving upside if inflation is quelled sooner than expected. The S&P 500 ended September up 7.99%, bringing its YTD return to -18.76%.

Figure 1: US annualized GDP results per quarter (2021–2022)

The U.S. reported an annual core inflation rate of 6.6% in September, setting a new four decade high. This rise was mainly due to increases in the price of services which offset reductions in the price of goods and energy. Annual headline inflation was 8.2% for September, down slightly from August. Other economic indicators released in October offered mixed signals as to whether inflation has peaked. Illustrating a strong economy, The U.S. reported annual third quarter GDP growth of 2.6%, the first positive quarter this year, alongside a decrease in the unemployment rate. However, conflicting data showed a contraction in U.S. manufacturing activity and a decrease in the Consumer Confidence Index. Investors will look for guidance from ensuing inflation data, and the Federal Reserve’s November and December rate decisions.

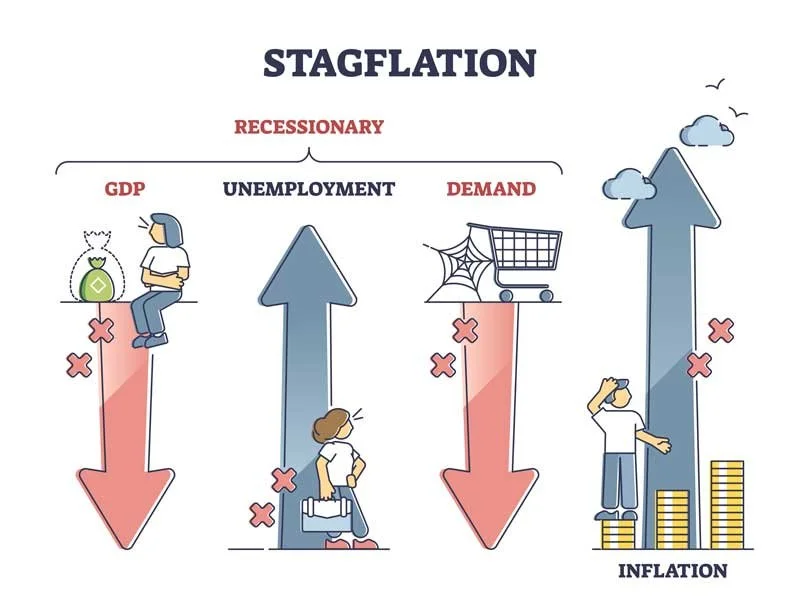

The European Central Bank (ECB) raised interest rates by 75 basis-points in October, as Euro area inflation reached 10.7% annualized in October. This is the third consecutive rate hike for the ECB, leaving deposit rates at their highest levels since 2009. Despite persistent inflation, business activity in the eurozone contracted for the fourth month in October, heightening recession worries and the risk of “stag-flation.” The ECB has been less aggressive than other central banks in raising interest rates, and market participants anticipate a continued slowdown in the ECB’s rate hikes, which could push the EURO further below the USD.

In October, following a proposed change in fiscal policy that rocked financial markets, Liz Truss stepped down as the U.K.’s Prime Minister after only 44 days in office. Truss is the shortest standing U.K. Prime Minister in history, and will be replaced by former U.K. Finance Minister Rishi Sunak. Truss’s actions demonstrate the danger of long-term structural shifts in fiscal policy during this volatile market.

Figure 2: Characteristics of Stagflation

Despite reporting higher-than-expected third-quarter GDP results, Chinese equities continued to fall throughout October amidst new Covid-19 related lockdowns and changes in party leadership following the Communist Party’s 20th congress. Consolidating his power, President Xi Jinping stood by his Covid-Zero policy, and failed to announce expected stimulus measures, nor any further plans to re-open the country. The already struggling Yuan, depreciated to a new 14-year low versus the USD in October.

Continuing into November, market volatility will likely remain high as market participants and central banks await inflation results. We anticipate that lower inflation readings and a slowing of the pace of central bank interest rate increases will be needed before equities make any sustainable rebound. Even without a decrease in inflation, policy makers could begin tempering the pace of rate hikes to blunt their delayed impact on the economy and the risk of “stag-flation” with high interest and slow growth.